Over the last few years, carriers have seen their insurance premiums climb—up 12% from 2017 to 2018, according to the latest American Transportation Research Institute (ATRI) study. Specialized carriers, such as tankers or oversize load trucks, also pay more due to the increased risks associated with the types of loads they transport.

This increase in insurance premiums is said to be attributable to

- Increased litigation

- Growing congestion—more people on the road means a higher risk of accident

- Higher vehicle prices, and subsequently, higher repair costs

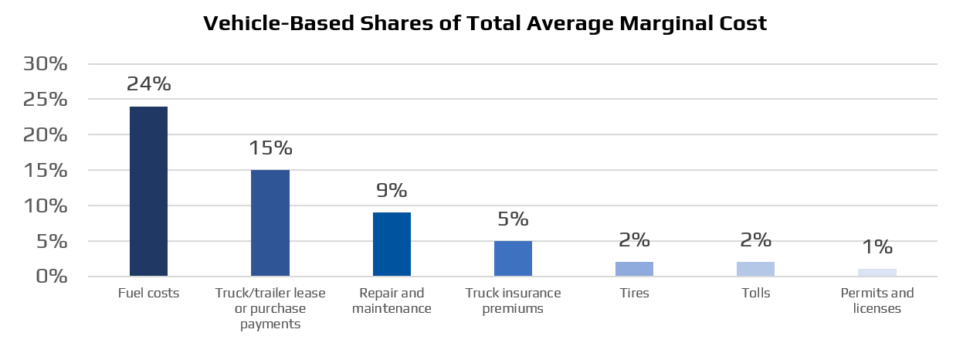

Insurance premiums are among the main operational costs of carriers, as illustrated below. This article discusses how telematics and telemetry data help lower costs while promoting safety across carrier fleets.

How Insurance Companies Set Premiums

Before discussing how telematics can affect insurance premiums, it’s worth looking at the elements that are taken into account when rates are set. While this is not an exhaustive list, the main factors include

- Fleet size

- Travel locations (states, provinces, countries, etc.)

- Types of loads

- Driver hiring process and procedures

- Risk management/safety programs

- Safety score

- Losses

- Loss control and management

- Training programs

- Company culture

As you can see, you can control and improve some of these elements. And telematics can have a positive impact on several of these factors.

How Telematics Helps Carriers

Telematics collects data for in-depth analysis to assist in decision-making. This type of data is highly useful when calculating risk and for accident reconstruction. It provides an exact view of what the driver was doing at the moment of impact—was their foot on the accelerator or the brake pedal? Safety managers thus have a better understanding of driver behavior at all times.

Using real-time data inside the cab also has a positive impact on drivers. A system that warns the driver in real time—in a non-distracting way, of course—about the sudden maneuvers he makes contributes to continuous training. To be effective and safe, the telematics system must meet installation standards and not interfere with the driver’s visibility.

With this telemetry data in hand, carriers must then consider what to do with it. In practical terms, does the carrier.

- Monitor the data

- Learn from the data

- Develop new programs

- Adjust existing programs

- Develop or improve current training programs

- Set up incentive programs

“If carriers leverage their telematics systems and use the data proactively to set up effective programs, it will have a positive impact on their insurance rates. The reverse is also true. Carriers who do not use their data and have no programs or controls in place will be less attractive to insurers. Their rates could suffer, and they could even have a hard time securing insurance,” says John Farquhar, Risk Solutions Specialist at Summit Risk Solutions.

How to Better Control Compliance

Beyond monitoring risk management data, carriers can use telematics to better manage and control regulatory compliance. Electronic recording presents a host of benefits and ensures actions and decisions are tracked. For example, it can be used to remind drivers to conduct their DVIR or have their wheels retorqued, or to notify them that maintenance is due soon. The compliance of the driver, truck and fleet is particularly important since in case of an accident, it will be scrutinized. Imagine the impact on your claims if your driver was not compliant at the time of the accident! It is preferable to put all the chances on your side and use telematics to ensure your compliance.

Telematics also allows office personnel to access information concerning:

- Driver hours-of-service violations

- Electronic vehicle inspections

- Real-time vehicle surveillance

- Vehicle maintenance reports

- Vehicle diagnostic codes and alerts

To maximize compliance efforts, promote driver involvement by giving them a voice to suggest solutions and improvement opportunities when it comes to current programs.

How Dashboard Cameras Influence Insurance Premiums

Integrated to a telematics system, dashboard cameras help combine the power of images with irrefutable data for an exhaustive understanding of critical events. They make it possible to understand the context in which sudden maneuvers and accidents occur, as well as to identify drivers with hazardous driving habits.

Not only are cameras increasingly popular in fleets, they are also in growing demand by most insurance claim services to help assign responsibility in the event of an accident. Beyond the evidence they can provide, cameras are also appreciated by insurers as they help support and train drivers on safer driving behaviors. Fleets that maximize the use of video technology get positive results by reducing the number of accidents they are involved in and managing risk to avoid future accidents. By lowering or eliminating accidents, fleets can positively influence their insurance premiums.

In Conclusion: How to Lower Your Insurance Premiums

Better Risk Management; this is the take-away of what carriers can do to get their insurance premiums down. You have to understand the actual risks associated with running your business. Risk management involves much more than compliance. Well-managed operations can yield tangible results that reduce or even eliminate accidents and violations. An excellent risk management program and sound company culture are key to maintaining a good safety score, facilitating proper equipment maintenance, and lowering employee turnover. You can’t manage what you don’t measure! Insurers look for this combination of elements, and that is how you can attain manageable insurance rates.

*Thanks to John Farquhar, Risk Solutions Specialist at Summit Risk Solution for his collaboration in preparing this article.